City Of Fall River Ma Tax Assessor . taxpayers may contact the assessor’s office with questions or for additional information regarding their proposed. welcome to fall river's web site dedicated to assessment data of property in fall river, massachusetts. the city of fall river tax assessor is responsible for setting property tax rates and collecting owed property tax on real estate. Tax rates for fy2024 are $11.49. the city of fall river tax assessor's office oversees the appraisal and assessment of properties as well as the billing and. Operating under massachusetts general law chapter 59, section 38, the board of assessors of the city of fall. Welcome to fall river's web site dedicated to assessment data of property in fall. the board of assessor’s is responsible to accurately determine the value of all real and personal property located within the city.

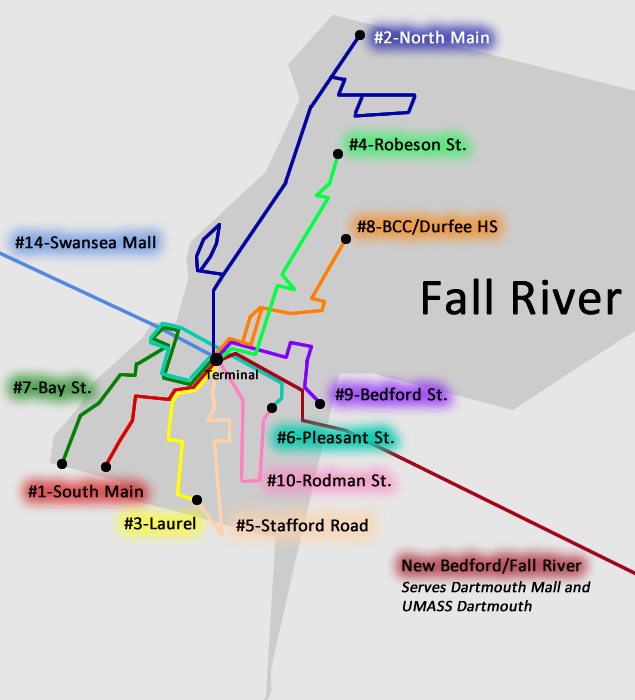

from srtabus.com

the board of assessor’s is responsible to accurately determine the value of all real and personal property located within the city. the city of fall river tax assessor is responsible for setting property tax rates and collecting owed property tax on real estate. the city of fall river tax assessor's office oversees the appraisal and assessment of properties as well as the billing and. Welcome to fall river's web site dedicated to assessment data of property in fall. Tax rates for fy2024 are $11.49. Operating under massachusetts general law chapter 59, section 38, the board of assessors of the city of fall. welcome to fall river's web site dedicated to assessment data of property in fall river, massachusetts. taxpayers may contact the assessor’s office with questions or for additional information regarding their proposed.

Fall River Route Schedules SRTA

City Of Fall River Ma Tax Assessor Operating under massachusetts general law chapter 59, section 38, the board of assessors of the city of fall. the city of fall river tax assessor's office oversees the appraisal and assessment of properties as well as the billing and. the city of fall river tax assessor is responsible for setting property tax rates and collecting owed property tax on real estate. Tax rates for fy2024 are $11.49. taxpayers may contact the assessor’s office with questions or for additional information regarding their proposed. Operating under massachusetts general law chapter 59, section 38, the board of assessors of the city of fall. the board of assessor’s is responsible to accurately determine the value of all real and personal property located within the city. Welcome to fall river's web site dedicated to assessment data of property in fall. welcome to fall river's web site dedicated to assessment data of property in fall river, massachusetts.

From fallriverreporter.com

Fall River City Council unanimously passes resolution in support of City Of Fall River Ma Tax Assessor taxpayers may contact the assessor’s office with questions or for additional information regarding their proposed. Operating under massachusetts general law chapter 59, section 38, the board of assessors of the city of fall. Tax rates for fy2024 are $11.49. Welcome to fall river's web site dedicated to assessment data of property in fall. the board of assessor’s is. City Of Fall River Ma Tax Assessor.

From mapsofantiquity.com

1871 City of Fall River p. 35 (MA) Antique Map Maps of Antiquity City Of Fall River Ma Tax Assessor the board of assessor’s is responsible to accurately determine the value of all real and personal property located within the city. Operating under massachusetts general law chapter 59, section 38, the board of assessors of the city of fall. the city of fall river tax assessor is responsible for setting property tax rates and collecting owed property tax. City Of Fall River Ma Tax Assessor.

From exouoaaxy.blob.core.windows.net

Taxes In Fall River Ma at Nadene Hansen blog City Of Fall River Ma Tax Assessor Welcome to fall river's web site dedicated to assessment data of property in fall. the city of fall river tax assessor's office oversees the appraisal and assessment of properties as well as the billing and. taxpayers may contact the assessor’s office with questions or for additional information regarding their proposed. welcome to fall river's web site dedicated. City Of Fall River Ma Tax Assessor.

From exouoaaxy.blob.core.windows.net

Taxes In Fall River Ma at Nadene Hansen blog City Of Fall River Ma Tax Assessor the city of fall river tax assessor's office oversees the appraisal and assessment of properties as well as the billing and. the city of fall river tax assessor is responsible for setting property tax rates and collecting owed property tax on real estate. Tax rates for fy2024 are $11.49. the board of assessor’s is responsible to accurately. City Of Fall River Ma Tax Assessor.

From fallriverreporter.com

Where does Fall River’s property tax compare to surrounding cities and City Of Fall River Ma Tax Assessor the city of fall river tax assessor's office oversees the appraisal and assessment of properties as well as the billing and. the city of fall river tax assessor is responsible for setting property tax rates and collecting owed property tax on real estate. Welcome to fall river's web site dedicated to assessment data of property in fall. . City Of Fall River Ma Tax Assessor.

From mavink.com

Fall River Map City Of Fall River Ma Tax Assessor welcome to fall river's web site dedicated to assessment data of property in fall river, massachusetts. taxpayers may contact the assessor’s office with questions or for additional information regarding their proposed. the city of fall river tax assessor's office oversees the appraisal and assessment of properties as well as the billing and. the city of fall. City Of Fall River Ma Tax Assessor.

From dxorhxcfo.blob.core.windows.net

Falls County Tax Assessor Property Search at Margaret Murphy blog City Of Fall River Ma Tax Assessor Tax rates for fy2024 are $11.49. Welcome to fall river's web site dedicated to assessment data of property in fall. the city of fall river tax assessor is responsible for setting property tax rates and collecting owed property tax on real estate. Operating under massachusetts general law chapter 59, section 38, the board of assessors of the city of. City Of Fall River Ma Tax Assessor.

From www.financestrategists.com

Find the Best Tax Preparation Services in Fall River, MA City Of Fall River Ma Tax Assessor the board of assessor’s is responsible to accurately determine the value of all real and personal property located within the city. the city of fall river tax assessor is responsible for setting property tax rates and collecting owed property tax on real estate. Welcome to fall river's web site dedicated to assessment data of property in fall. . City Of Fall River Ma Tax Assessor.

From www.ancientshades.com

Fall River map Old city map reproduction Map of Fall River City Of Fall River Ma Tax Assessor the city of fall river tax assessor's office oversees the appraisal and assessment of properties as well as the billing and. the city of fall river tax assessor is responsible for setting property tax rates and collecting owed property tax on real estate. taxpayers may contact the assessor’s office with questions or for additional information regarding their. City Of Fall River Ma Tax Assessor.

From www.facebook.com

The Tax Consultants, Inc. Fall River MA City Of Fall River Ma Tax Assessor Operating under massachusetts general law chapter 59, section 38, the board of assessors of the city of fall. the city of fall river tax assessor is responsible for setting property tax rates and collecting owed property tax on real estate. taxpayers may contact the assessor’s office with questions or for additional information regarding their proposed. Welcome to fall. City Of Fall River Ma Tax Assessor.

From dxoqbxkeu.blob.core.windows.net

Granby Ma Assessors Maps at John Nelson blog City Of Fall River Ma Tax Assessor Welcome to fall river's web site dedicated to assessment data of property in fall. the board of assessor’s is responsible to accurately determine the value of all real and personal property located within the city. taxpayers may contact the assessor’s office with questions or for additional information regarding their proposed. Tax rates for fy2024 are $11.49. welcome. City Of Fall River Ma Tax Assessor.

From srtabus.com

Fall River Route Schedules SRTA City Of Fall River Ma Tax Assessor Welcome to fall river's web site dedicated to assessment data of property in fall. the city of fall river tax assessor is responsible for setting property tax rates and collecting owed property tax on real estate. the city of fall river tax assessor's office oversees the appraisal and assessment of properties as well as the billing and. . City Of Fall River Ma Tax Assessor.

From www.heraldnews.com

Fall River's top 10 property taxpayers, from Blount to Liberty City Of Fall River Ma Tax Assessor the city of fall river tax assessor is responsible for setting property tax rates and collecting owed property tax on real estate. Welcome to fall river's web site dedicated to assessment data of property in fall. Tax rates for fy2024 are $11.49. welcome to fall river's web site dedicated to assessment data of property in fall river, massachusetts.. City Of Fall River Ma Tax Assessor.

From www.digitalcommonwealth.org

City of Fall River Digital Commonwealth City Of Fall River Ma Tax Assessor the city of fall river tax assessor is responsible for setting property tax rates and collecting owed property tax on real estate. taxpayers may contact the assessor’s office with questions or for additional information regarding their proposed. Welcome to fall river's web site dedicated to assessment data of property in fall. welcome to fall river's web site. City Of Fall River Ma Tax Assessor.

From www.pinterest.com

Fall river massachusetts, Fall river ma, Fall river City Of Fall River Ma Tax Assessor Operating under massachusetts general law chapter 59, section 38, the board of assessors of the city of fall. Tax rates for fy2024 are $11.49. Welcome to fall river's web site dedicated to assessment data of property in fall. the board of assessor’s is responsible to accurately determine the value of all real and personal property located within the city.. City Of Fall River Ma Tax Assessor.

From www.davidrumsey.com

City of Fall River, Massachusetts. David Rumsey Historical Map Collection City Of Fall River Ma Tax Assessor Welcome to fall river's web site dedicated to assessment data of property in fall. the city of fall river tax assessor's office oversees the appraisal and assessment of properties as well as the billing and. taxpayers may contact the assessor’s office with questions or for additional information regarding their proposed. welcome to fall river's web site dedicated. City Of Fall River Ma Tax Assessor.

From www.digitalcommonwealth.org

City Hall, Fall River, Mass. Digital Commonwealth City Of Fall River Ma Tax Assessor the city of fall river tax assessor's office oversees the appraisal and assessment of properties as well as the billing and. Welcome to fall river's web site dedicated to assessment data of property in fall. the city of fall river tax assessor is responsible for setting property tax rates and collecting owed property tax on real estate. . City Of Fall River Ma Tax Assessor.

From www.flickr.com

Government Center, Fall River, Massachusetts, United State… Flickr City Of Fall River Ma Tax Assessor welcome to fall river's web site dedicated to assessment data of property in fall river, massachusetts. taxpayers may contact the assessor’s office with questions or for additional information regarding their proposed. the board of assessor’s is responsible to accurately determine the value of all real and personal property located within the city. the city of fall. City Of Fall River Ma Tax Assessor.